Forex

Apocalypto is a trend momentum system based on five indicators MT4:

Medium

term trend.

Market

strength.

Short

term trend.

Market

momentum (Price

must

be

on

the ‘right’

side

of the Moving Average

(above-BUY

/

SELL-below).

Trend

confirmation.

Full

compliance

of all

indicators.

Price

is

above the

average.

The

market is

ready

for

a

long position

(BUY).

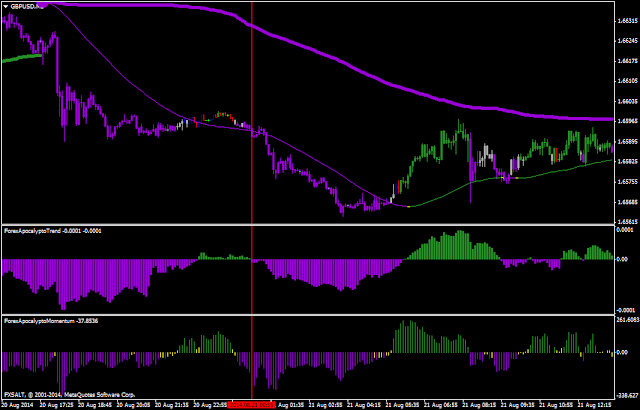

Example

of LONG trade (BUY).

Full

compliance

of all

indicators.

Price

is

above the

average.

Price broke the medium trend band. The

market is

ready

for

a

long position

(BUY).Example

of SHORT trade (SELL).

Full

compliance

of all

indicators.

Price

is

below the

average.

The

market is

ready

for

a

short position

(SELL).

Example

of SHORT trade (SELL).

Full

compliance

of all

indicators.

Price

is

below the

average.

Price broke the medium trend band. The

market is

ready

for

a

short position

(SELL).

It

may

happen

that you are

late

for

the

first

entry,

or

you trade conservatively

and

wait

for

further

confirmation

from

the market.

In

this case,

you

can always

look for re-entry at

a later

stage

of

the

movement.

The

condition is: the confirmation of

the

system

to

continue

moving

in

that direction.

When

to exit a trade

There

are several methods

for

closing

the

transaction. At

the first sign of decline in the strength of movement When price hit

major support and resistance levels, especially those confirmed at

high time intervals Dashboard: DB

is a small indicator located in the upper right corner. It provides

basic information about the market, like -: currency pair-

time interval -

time until another candlestick is open -

spread value -current price-

ADR (average daily range) indices .

- ADR indices show us two periods of time and the current (today's) price range. The first one (ADR 30) indicates a medium price range over the last month (last 30 days). The second one (ADR 5) shows us the price range throughout the last five days.

- How to put this information to practical use?Firstly, ‘Today Range’ indications tell us how much "space" left there is on a given instrument until the maximum is reached for the day. If, for example, TR shows 50pips, and ADR (5) and ADR (30) indicate 100pips, it's very likely the instrument you're observing will get closer to these values, providing additional 50pips of movement.

- Another very important piece of information from the indications of ADR is the change of the market's sentiment and dynamics, which can be derived from the mutual relation of ADR 30 and ADR 5.If ADR 5 is lower than ADR 30, it means the volatility prevalent on the market is currently decreasing, and a smaller price range for each day can be expected.If ADR 5 is higher than ADR 30, it means dynamics on the market are growing by the day, so you can count on greater movement range.

إرسال تعليق