Introduction

In the realm of forex and commodity trading, the ability to accurately gauge market trends and anticipate price movements is paramount. This precision is often sought through meticulous strategies that not only identify trends but also incorporate essential elements like support and resistance levels. The following trading model offers a systematic approach, blending technical indicators with strategic entry and exit rules, tailored to cater to both novice and seasoned traders.

Strategy Overview:

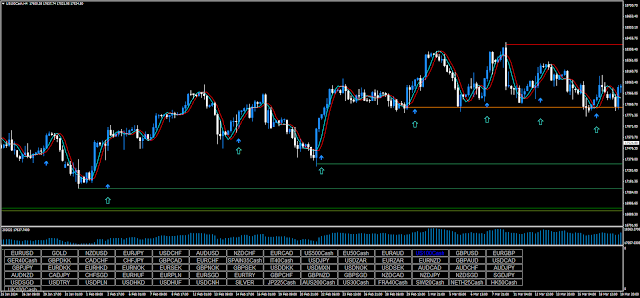

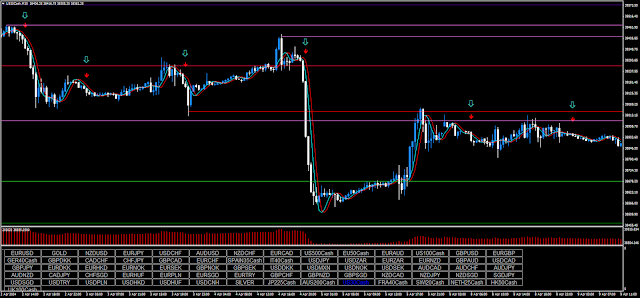

The trading strategy outlined below is designed to operate across multiple time frames (30, 60, 240) and on a different range of assets including major currency pairs, NASDAQ 100, Gold, Oil, and BTCUSD. Leveraging Metatrader 4 indicators, the approach integrates buy and sell signals, supported by Imax 3, Support and Resistance lines, Symbol Changer, and Squeeze Break indicators. By adhering to specific entry and exit criteria, traders can effectively capture favorable market movements while mitigating potential risks.

Trading Rules:

Buy Signals:

1. Confirmation of price above a designated support level.

2. Presence of a buy arrow indicator.

3. Imax 3 indicator displaying the blue line surpassing the red line.

4. Optional confirmation through a blue candle on the Trend indicator.

Sell Signals:

1. Confirmation of price below a defined resistance line.

2. Presence of a sell arrow indicator.

3. Imax 3 indicator shows the red line exceeding the blue line.

4. Optional confirmation through a red candle on the Trend indicator.

Exit Position:

1. Stop loss placement below the support level for buy positions, or above the resistance level for sell positions, depending on the trade direction.

2. Alternatively, stop loss can be set based on the most recent swing high/low.

3. Profit target ratio set at 1:1.2 or 1:1.3 relative to the stop loss.

Conclusion

The presented trading strategy offers a structured approach to navigating the dynamic landscape of financial markets. By incorporating precise entry and exit rules, reinforced by support and resistance levels, traders can enhance their decision-making process and optimize risk management. Whether utilized by beginners or seasoned professionals, this model provides a clear framework for executing trend-following trades with heightened precision and confidence.

Download

https://drive.google.com/drive/folders/1BxDE_vGb1ca1oLTYYMB8IvkDDqKwAsij?usp=sharing

Post a Comment