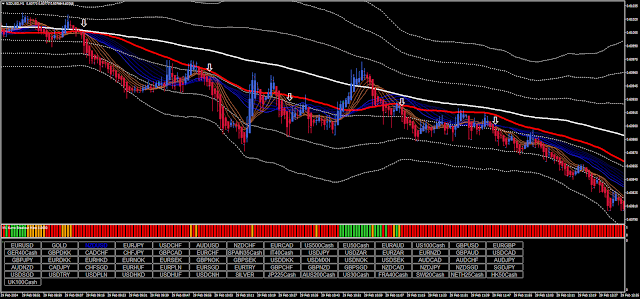

The "Scalping M1" forex strategy is a trend-following approach designed for rapid trading based on moving averages and two sets of moving average ranges (fast and slow). Additionally, it incorporates the Kumo breakout filter for entry timing. Within this method, slow Bollinger Bands are introduced in the setup as dynamic support and resistance levels, particularly beneficial for quick scalping endeavors (though they remain optional).

Strategy Setup - Scalping M1

Time Frame: 1 minute or higher

Currency Pairs: Major pairs

Maximum Spread: 0.0018

Indicators (MT4):

120-period Moving Average (120MA)

55-period Moving Average (55MA)

Bollinger Bands (120; 1)

Bollinger Bands (120; 2)

Bollinger Bands (120; 3)

High and Low Difference Moving Average (HADM)

Simple Moving Averages (SMA):

Fast (3, 5, 7, 9, 11, 13)

Slow (21, 24, 27, 30, 33, 36)

Kumo Breakout

Trading Rules

Buy

Kumo bar blue

55SMA > 120SMA

SMAfast > SMASlow

HDMA blue

Sell

Kumo Breakout red

55SMA < 120SMA

SMAfast < SMASlow

HDMA blue

Exit Position

Place Stop loss on SMA 55 (red line)

Target Profit (Two Options):

6 pips for AUD/USD, 8 pips for EUR/USD, 10 pips for GBP/USD

Exit at upper or lower bands of BB

It's advisable to initially implement this system at higher time frames.

Post a Comment