The Boom and Crash Trend (Asian Breakout) is an evolved strategy, refining the classic Asian Breakout method for intraday trading. Rather than adhering strictly to traditional practices, this strategy introduces innovative elements to optimize trading performance and adaptability.

Strategy Overview

This strategy is executed within a 30-minute timeframe, making it suitable for swift market movements. It applies to various currency pairs and cryptocurrencies, ensuring versatility in trading options. The key operational hours are between 11:30 pm and 4:00 am GMT Berlin, marked by the establishment of a trading range encapsulated within a rectangular box.

Setup

Utilizing MetaTrader 5 indicators, particularly the Asian Breakout Box, renamed as the Boom and Crash Trend Breakout for this strategy, along with Pivot Points levels and the ATR stop with default settings.

Time Frame 30 min.

Currency pairs; majors. minors, indices and Crypto

Trading Rules

The core principle of the Boom and Crash Trend Breakout strategy revolves around identifying and capitalizing on valid breakouts within the established trading range. The direction of the trend, as defined by the ATR stop, guides trading decisions.

Buy Signal

Execute a buy order when the price breaches the upper boundary of the trading range by at least 2 pips.

Sell Signal

Initiate a sell order when the price falls below the lower boundary of the trading range by at least 2 pips.

Risk Management

For stop-loss placement, traders have two options: either position the stop loss on the opposite side of the 00:00-04:00 candle tunnel or employ a more dynamic approach based on market conditions.

Profit-taking Strategy

Traders have multiple options for profit-taking:

Aim for a target of 20 pips and close the trade once this threshold is reached.

Implement a trailing stop based on the ATR or Pivot Points levels to maximize profits.

Recommended Money Management

Tailoring the money management approach to match trading preferences and risk tolerance is crucial. Traders can opt for an aggressive strategy like D'Alembert or adopt a more conservative approach such as Kelly or Oscar's Grind (Pluscoup).

In conclusion, the Boom and Crash Trend Breakout strategy represents a contemporary interpretation of the classic Asian Breakout method, incorporating advanced tools and risk management techniques to enhance trading efficiency and profitability in intraday markets.

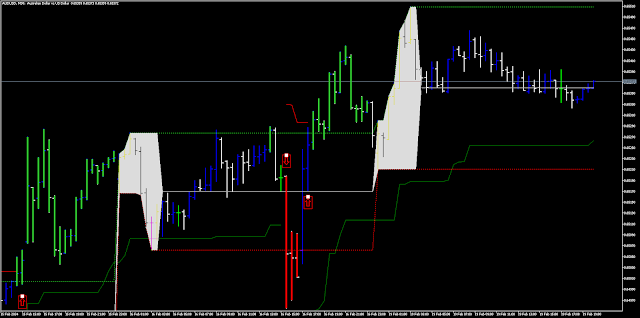

Illustrative Examples

Accompanying the strategy are visual representations of sample trades, offering practical insights into its application and potential outcomes.

Download

https://drive.google.com/drive/folders/1yuKGhJj-wwgEnlvaVqWseMG0PUTIn7QP?usp=sharing

Post a Comment