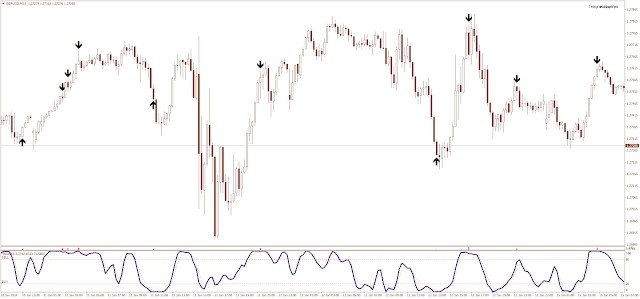

The Arrow with stochastic strategy is a straightforward momentum approach centered on an arrow indicator that identifies the peak and trough within a given range. Trading signals are triggered when the stochastic oscillator aligns with the arrow direction, either falling below the 80 level or rising above the 20 level.This strategy is characterized by its simplicity and clarity, making it suitable for traders of all experience levels. It boasts high profitability and can be applied across various assets, including currency pairs, Gold, Nasdaq 100, and Vix, on the Metatrader 4 platform.

Strategy Setup:

Time Frame: 5 minutes or higher.Applicable Instruments: Any currency pairs, Gold, Nasdaq 100, Vix.Trading Platform: Metatrader 4.

Indicators (Metatrader 4):

Arrow

Stochastic (11, 3, 3).

Trading Rules

Long Trades:

Look for a buy arrow below the candle on the main chart. Wait for the Stochastic Oscillator to cross upwards and be above the 20 level.

Short Trades:

Observe a sell arrow above the candle on the main chart. Wait for the Stochastic Oscillator to cross downwards and be below the 80 level.

Exit Trade:

Set the stop loss at 10, 20, 30, 40, or 50 pips, depending on the chosen time frame.Take profit when the stochastic reaches the opposite side or maintains a minimum stop loss ratio of 1:1.

Trading Examples:

Note: It is essential for traders to thoroughly test any strategy in a simulated environment before deploying it in live trading. Additionally, risk management practices should be adhered to for optimal results.

Link for download:

Post a Comment